Congestion Pricing for Road Finance: Time to Replace Gasoline Taxes?

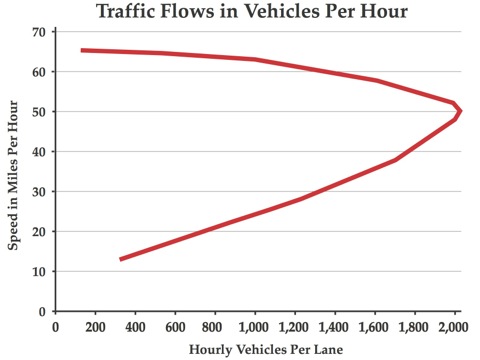

By Randal O'Toole -- June 13, 2012“[Gasoline] taxes do not properly price roads, with the result that traffic congestion costs Americans close to $200 billion per year…. Congestion pricing can … nearly double actual road capacities during rush hour, from 1,000 to 2,000 vehicles an hour.”

Gasoline and diesel fuel taxes have long been the main source of funding for building, maintaining, and operating America’s network of highways, roads, and streets. This is why the American Petroleum Institute nearly a century ago worked to enact such levies, welcoming taxes on its product to enable systemic road building to increase the demand for its chief product.

Today’s motor-fuel taxes are, at best, an imperfect user fee. One problem is that inflation and increasingly fuel-efficient cars have rapidly eroded gas tax revenues. After adjusting for inflation, drivers today pay only a third as much for each mile they drive as they did in 1956, when Congress created the Interstate Highway System.

Raising the pump tax would alleviate this problem, at least temporarily. But it won’t fix its other problems. The biggest is that gas taxes do not properly price roads, with the result that traffic congestion costs Americans close to $200 billion per year.

Another problem is that gas taxes are collected mainly by the federal and state governments, and local governments must find $30 billion in general funds each year to maintain county roads and city streets. As a result, local roads and bridges tend to be in poorer condition than highways funded out of user fees.

My New Study

On May 14, the Cato Institute published my new paper, Ending Congestion by Refinancing Highways, which made a case that replacing gas taxes with vehicle-mile fees could solve all of these problems. Such fees would be flat on uncongested roads and vary with the amount of traffic on congested roads.

The paper argues that congestion pricing is particularly important for highways, which are the only resource whose supply actually declines when demand increases.

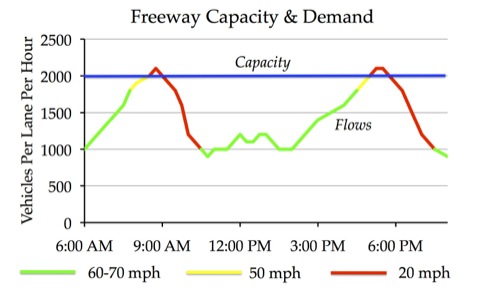

A typical freeway lane can move about 2,000 vehicles an hour in free-flowing traffic, but when the road becomes congested, traffic flows can decline below 1,000 vehicles per hour. Even if traffic demand exceeds 2,000 vehicles an hour for only a few minutes, stop-and-go traffic can result for hours until demand falls below 1,000 vehicles per hour. Congestion pricing can therefore nearly double actual road capacities during rush hour, from 1,000 to 2,000 vehicles an hour.

While economists have long understood the benefits of congestion pricing, some people object to converting highways that are now “free” into congestion-priced roads, fearing they are being charged twice to use the same roads. The Cato paper answers this objection by proposing to eliminate gas taxes, thus eliminating any fears that people are being charged twice.

Experiments with vehicle-mile fees in Oregon have shown that it is possible to collect such fees without invading traveler privacy. A GPS or similar device on board a vehicle keeps track of how much drivers owe and reports this to a specially equipped gasoline pump when the driver fills up the car’s tank. The amount of payment could be broken down by road system–state, county, city, or private–but otherwise the device would not report when or where the car went on various roads.

The state estimated that the system it used could be installed on all gasoline pumps in Oregon for about $33 million and that the cost of GPSs would be about $100 per car, though that cost could decline with advances in technology and mass production. The system wouldn’t have to use dedicated GPSs; it could use smart phones, transponders, or other common devices.

A recent report from the Congressional Budget Office concluded that automobile fuel efficiency is growing faster than driving, meaning that gas tax revenues will steadily decline. Given this, the transition to vehicle-mile fees is inevitable. However, the faster that transition takes place, the sooner we will be able to relieve traffic congestion and fix other inequities with highway funding.

As such, Congress and the states should take action to rapidly transition from gas taxes to more efficient vehicle-mile fees. Any state can take the lead by switching from gas taxes to mileage-based fees, but as more states switch, they will need to coordinate to make sure their systems are compatible with one another. One side-effect from the switch will be a devolution of transportation funding from the federal government to the state and local level, which will depoliticize many transportation decisions.

Graphics

The maximum flow capacity of a typical freeway lane is about 2,000 vehicles per hour. However, when demand exceeds that capacity, flows fall to 1,000 vehicles per hour or less, cutting traffic flows in half as seen in Figure 1.

Even if traffic flows exceeds the maximum flow capacity of a highway for only a few minutes, the resulting decline in flows can lead to hours of stop-and-go traffic, indicated by the red line in Figure 2.

The problem with this whole idea is what happens when environmentalists get a hold of this changing regulations so that suddenly if you drive an SUV it’s twice the cost of an compact. This type of system will quickly turn into a tool to kill larger vehicles by making them too expensive to operate over long distance commutes. A flat rate at the pump for all is still a far better way to do things. It also removes government budgetary responsibility. If better millage cars reduce revenues then the government should reduce expenses, raise the tax at the pump, or raise taxes in other areas.

I think my preference, if there must be a government system, would be for an electronic toll system that kept track of where you got on the highway, and off it, and charged based on the distance between the on and off toll locations. A GPS system that tracks your every mile driven is a horrifying idea. Big Brother much?

Great figures. Hysteresis is such an interesting phenomena to study because it shows up in so many different applications. The key, as your point out, is keeping the system from going past the critical point. (which appears to be ~2000 vehicles per lane.)

California has tried to solve the problem of too much demand at rush hour by limiting the number of cars that can enter the freeway at each intersection. Are other states limiting the number of vehicles on freeways during rush hour?

Your idea of paying congestion fees seems interesting, if used in combination with the existing system for limiting the number of cars. There’s no way to really prevent more than ~1700 vehicles/lane/hour unless you have a system that doesn’t let more vehicles on. The GPS device you mention would just make people pay more during rush hour, but it doesn’t limit the number of vehicles to below 2000…unless people knew how much they were being charged to get on the freeway before they left their office.

While gasoline taxes don’t account for the problem of congestion, they do a pretty good job of assigning costs of road damage to those people who use the roads.

The major problem I see with the road system is the shear waste of tax payers dollars during the summer months for continual road construction. There’s always road construction, and there’s hardly ever anybody doing any work. Most of the time, the freeways narrow down to one lane, but there’s nobody actually doing any work. One problem, in many states and in many countries, is the political corruption between the Transportation agencies and the companies bidding to build/repair the roads. We could lower taxes/fees if we could increase the competition and change the bid requirements to focus more on using road materials that can last longer before the next repair.

This is what happens when you have a socialist government. In reality, this is all about driving the public transport agenda and forcing people onto buses.

What you end up with is roads for the rich.

Won’t fix traffic at peak times as most of us will still need to be at work between 8 and 9 am and leave around 5. No fee system or toll will change this. Proof, look at the bridges going into NYC. Huge toll increases for that “mile driven” and no change in peak congestion. What proponents of this idea forget, is that a gas tax IS a user fee which promotes fuel efficiency. We should raise it, it has not gone up in a long time at the federal level. Why spend millions in new tech and devices when the system is already in place. Besides, you start putting govt GPS in vehicles, I guarantee lawsuits and fraud. Right now, you want to go somewhere, you pay a gas tax. Works great!

Andrew { 06.13.12 at 12:14 pm }

“Resist we much!” 🙂

Nothing wrong with gas taxes. Just make them revenue neutral by adjusting the rate as the fleet efficiency goes up. This is not raising taxes. All the other schemes are much more complicated, require exotic and expensive collection schemes, and have big brother privacy issues.

As the owner of a cab company in Phoenix Arizona, I can tell you now that such a scheme as you propose will heavily impact commercial transportation. Furthermore, I am terribly concerned with the idea that anyone other than the owner can have access to GPS data on where a vehicle has been. This is a horrible violation of privacy. “A GPS… on board a vehicle keeps track of how much drivers owe and reports this to a specially equipped gasoline pump when the driver fills up the car’s tank. The amount of payment could be broken down by road system–state, county, city, or private–but otherwise the device would not report when or where the car went on various roads.” And you believe that??

The cell phone companies flopped over and gave all their records to the government at the mere request of the Bush administration.

Here is an idea: If you want to tax vehicles based upon mileage, why not just read the stinking odometer when the car’s tags come up for renewal? Duh!

Who the hell came up with this asinine idea? He ought to be deported to Cuba where he will fit right in.

This is a scheme that so-called libertarian think tanks have been promoting for years. For some reason they are willing, even eager to give up a fundamental aspect of freedom, privacy, in order to improve on an “imperfect user fee”. Who gives a damn if it is not perfect? We will soon discover how imperfect congestion pricing is when government uses the technology to track our every movement. America is going to end up with a “kinder, gentler” Stasi thanks to inside-the-beltway libertarian think tanks. I stopped supporting the author’s think tank when I found out what they were up to.