Carbon Tax Foolishness

By Donn Dears -- April 6, 2017“… getting 195 countries to establish the same price on carbon would be an impossibility as each country would attempt to establish a price that would benefit itself in international trade.”

One could say two former Republican secretaries of state, Messrs. Baker and Shultz, are naive and badly informed. Their proposal for a carbon tax smacks of fools rushing in.

Their proposed carbon tax is part of a proposal by the Climate Leadership Council. This “carbon tax” is a tax on CO2 emissions, based on the supposed need to cut CO2 emissions to prevent a climate catastrophe.

Major Flaws

A “carbon tax” is fundamentally a bad proposal for several reasons.

First, Baker and Shultz propose to return a dividend to the poor, because it’s the poor who are hurt the most by any attempt to cut CO2 emissions. That is, the poor pay a higher proportion of their income for electricity and energy than do wealthier people.

This is pie-in-the-sky reasoning, because legislators will eventually see the tax as an opportunity to increase government revenues and spending. That’s the real-world outcome of any such dividend proposal.

Second, it tries to entice the Trump administration into establishing a regime of import tariffs if other countries don’t establish a tax on carbon. Without reciprocal taxation, manufacturing would flee the US for more tax friendly jurisdictions, and we would import the goods that would have been produced in our own country. (And global carbon emissions would not be reduced.)

US-side tariffs are unnecessarily confrontational, while getting 195 countries to establish the same price on carbon would be an impossibility as each country would attempt to establish a price that would benefit itself in international trade.

Third, Baker and Shultz want to begin with a tax of $40 per ton, which is higher than the Obama administration’s social cost of carbon (SCC) of $36, while proposing that a panel should review the tax in five years to see whether it should be increased.

Extreme environmentalists who clamor for cuts in CO2 emissions won’t agree to the Baker and Shultz proposal because they want money to be spent on such things as wind and solar energy and on energy efficiency. This was demonstrated in Washington State when a carbon tax was voted down, largely because extreme environmentalists opposed the proposal because it was revenue neutral and money wasn’t being spent on their pet projects.

What ‘Social Cost’?

In addition, it’s important to understand that models from which the social cost of carbon are calculated provide widely different answers depending on the assumptions used.

Three charts were selected from Dr. Kevin Dayaratna’s presentation at the 12th International Conference on Climate Change to demonstrate that:

- CO2 could provide benefits, rather than costs.

- The choice of the discount rate has a huge effect on the outcomes generated by the three computer models (DICE, PAGE, and FUND) used for determining the cost of carbon.

- The Equilibrium Climate Sensitivity (ECS) also affects the outcomes.

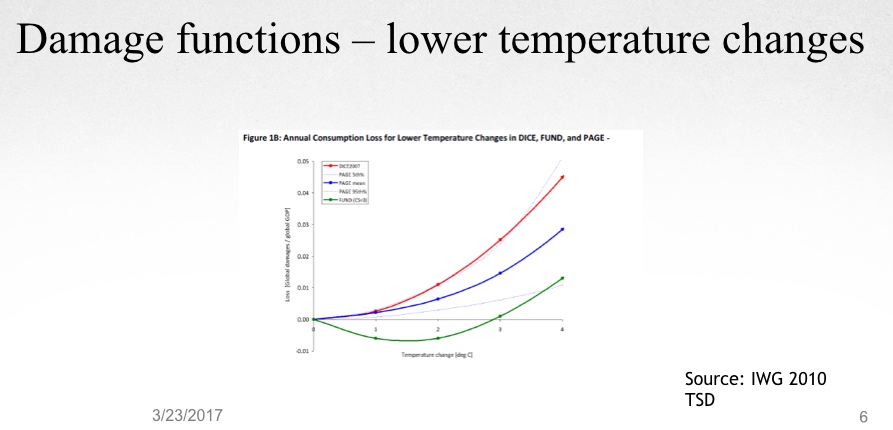

Results from the DICE, PAGE and FUND models are shown in the graph.

- FUND model results (green) indicate there are benefits from carbon dioxide and that there could be no SCC, or even a negative cost.

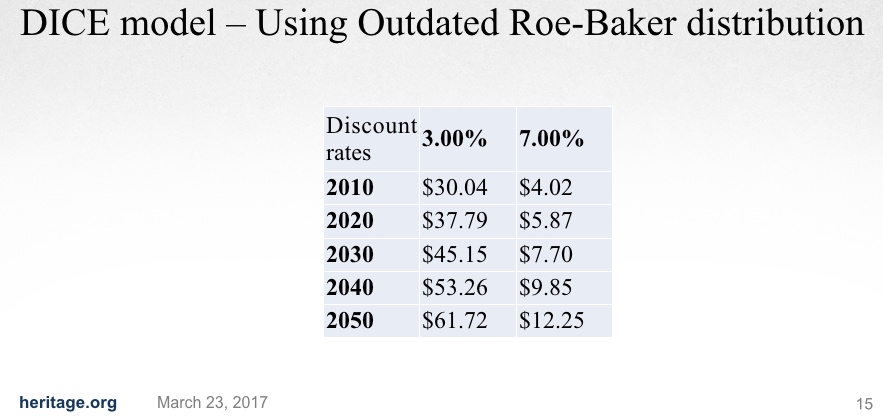

The assumed discount rate has an important effect on the model’s results. The differences between a 3% and a 7% discount rate are shown in the tables below. The Office of Management and Budget (OMB) recommended a 7% discount rate, while the Obama Administration used 3% when determining its SCC of $36 per ton.

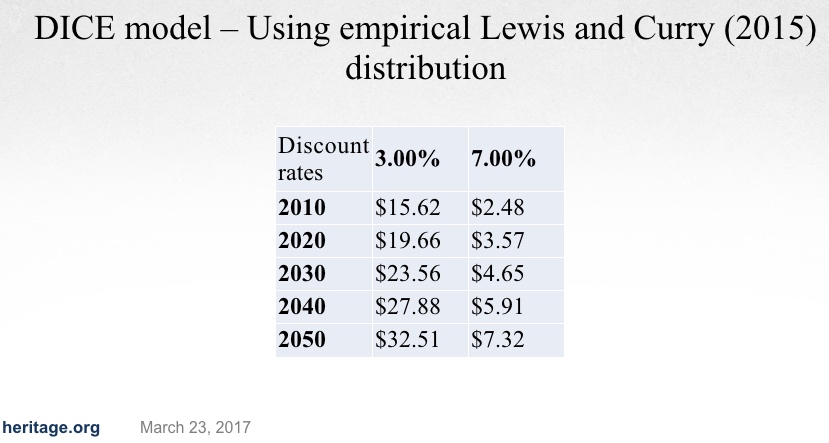

The first table below uses an outdated ECS, while the second uses a more recent ECS. Both charts show the difference between a 3% and 7% discount rate.

Model shows effect of discount rates when using old ECS

Model shows effect of discount rates when using new ECS

- In both examples, the cost of carbon is much lower when a more realistic 7% discount rate is used.

Summary

As established in my book CLEXIT: For a Brighter Future, it’s impossible to cut CO2 emissions enough to stop any climate catastrophe, even if CO2 has some effect on climate change.

Cutting worldwide CO2 emissions 50% by 2050 is impossible. Cutting US emissions 80% by 2050 is also impossible …. unless we accept returning to a lifestyle of the 1800s where horses were the main form of transportation, and air-conditioning, air planes and MRIs were unavailable. (These targets i.e., 50% and 80% by 2050, are the targets established by the United Nations and the EPA for preventing a climate catastrophe.)

These targets are impossible to meet, therefore, Messrs. Baker and Shultz are asking Americans to sacrifice their living standards for an impossible goal. Furthermore, the evidence shows that the social cost of carbon (SCC) is small and possibly negative, i.e., beneficial, indicating there is no need for putting a price on carbon.

Carbon Tax Impact On A Typical Family, as reported on VTDigger:

– The carbon tax would impose a $10 per ton tax of carbon emitted in 2017, increasing to $100 per ton in 2027.

– The carbon tax would generate about $100 million in state revenue in 2019 and about $520 million in 2027.

– The carbon tax would be added to the fuel prices at gas stations and fuel oil/propane dealers. Drivers should expect a tax increase of 9-cent per gallon of gasoline in 2017, increasing to about 89 cents in 2027.

– Homeowners, schools, hospitals, businesses, etc., should expect a tax increase of 58-cent tax per gallon of propane and $1.02 per gallon of heating oil and diesel fuel in 2027.

– A typical household (two wage earners, two cars, in a free-standing house) would pay additional taxes in 2027 of about:

– Some of the carbon tax extortion would be at the pump, some when the monthly fuel bills arrive, and some as higher prices of OTHER goods and services.

Driving = $0.89/gal x 2 x 12000 miles/y x 1/(30 miles/gal) = $712/y

Heating = $1.02/gal x 800 gal/y = $816/y

Total carbon tax in 2027 = $1528/y

Sales tax reduction 5/6 x 1400 = $233/y

Net tax increase = $1295/y

– The hypocritical sop of reducing the sales tax from 6 to 5 percent would save that household about $233 in sales taxes, for a net loss of $1295 in 2027. That means such households, the backbone of the Vermont economy, would have about $1300/y less to make ends meet.

– Many of these households have had stagnant or declining, spendable real incomes (after taxes, fees, surcharges; other recurring expenses, etc.), plus dealing with a near-zero, real-growth Vermont economy, since 2000.

– With less real income, and higher real prices for goods and services, they also would have to make their own energy efficiency improvements.

http://watchdog.org/250281/carbon-tax-debate-vermont/

For carbon, even a 7% discount rate is way too low; especially for “low income” consumers.