Power Generation Industry Forecast: Natural Gas as Fuel of Choice, Little Change for Other Technologies (Part II)

By Robert Peltier and Kennedy Maize -- January 14, 2010In Part I of this two-part post, we presented our observations of a power generation industry that will likely become more dependent on natural gas as a source of fuel for new power plants constructed in the coming years. Other fuel-based technologies (principally nuclear and coal) don’t seem to have the wherewithal to grab a larger piece of what should be a growing demand for electricity in the U.S. Both will be lucky to maintain their market share in the future. Renewables, with high levels of production tax credits, coupled with legislative mandates, will continue to grow in installed capacity but will contribute little to peak demand reduction. And should politically correct renewables (not hydropower) lose part or all of its government support, say as part of a deficit reduction program, then market share will actually be lost.

What follows is what we believe to be the future path of the remaining fuel-based power generation alternatives in 2010 and beyond.

Nuclear power, the last best hope for zero-carbon emissions from baseload generating plants, was many analysts’ early pick for a generating revival in the first decade of the 21st century. If one accepts the conventional view of climate change, the rational case for nukes appears unassailable. If you want low-carbon generation, you must go nuclear, period. (Gas-fired capacity to firm intermittent sources of power makes carbon-free wind and solar an illusion.)

The first decade of our new century has passed. After years waiting for the nuclear renaissance, it doesn’t look as if the second decade will bring the nuclear industry closer to revival. Indeed, the horizon may be receding. Literature Nobel laureate Samuel Becket could not have had U.S. nukes in mind when he wrote his iconic 1953 play, Waiting for Godot. But some of its dialog is eerily on target. The character Vladimir in the second act comments, “What are we doing here, that is the question. And we are blessed in this, that we happen to know the answer. Yes, in this immense confusion one thing alone is clear. We are waiting for Godot to come.”

In the U.S., we are into the second decade of the 21st century, waiting for the nuclear renaissance, after the market collapsed in the 1970s. Waiting and waiting.

Nuclear power plants won’t pick up U.S. generating market share in 2010, by all accounts. That’s despite prior federal government policy aimed at jump-starting new nuclear generation, including allegedly streamlined federal regulations and a longed-for candy jar of additional subsidies, such as major loan guarantees, pledged in the Republicans’ Energy Policy Act of 2005. Those have yet to materialize.

Some in the Obama administration and Congress are contemplating additional loan guarantees and other nuclear subsidies, to be included in pending climate change legislation. Arguing for $50 billion in additional federal loan guarantees, Exelon CEO John Rowe told a Senate committee in late October, “Deployment of new nuclear plants simply will not happen, given the large up-front capital costs, without a much more robust federal loan guarantee program than currently exists.” There doesn’t seem to be much enthusiasm on either side of the partisan aisle for committing that kind of money to nuclear power.

The 2005 congressional vision (perhaps a hallucination) was of a modest new fleet of nukes—a dozen or so—that would come into the U.S. market and revitalize the stagnant industry. New reactor designs from U.S., Japanese, and French companies; interest from multiple utilities; applications for more than 30 units under the streamlined approach of the Nuclear Regulatory Commission’s (NRC) licensing reforms of the 1990s; and the Energy Policy Act of 2005 all led to irrational exuberance among nuclear power developers. The 2005 loan guarantees would jump-start the market, the legislation assumed and the industry agreed.

More than four years later, the presumably vibrant market for new nukes in the U.S. is becalmed at best. That’s a factor of the worldwide economic collapse of 2007–2009, combined with U.S. regulatory and technical difficulties afflicting the new, putatively safer and more efficient nuclear reactors, plus the industry’s inability to deliver on promises of new reactor designs that will be easier, quicker, and cheaper to build. Then there is the unwillingness of anyone with real money to finance new plants.

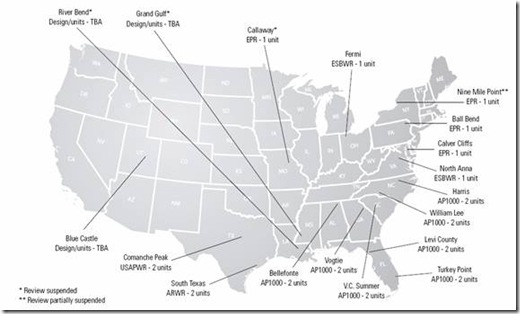

The NRC has been unable to certify the latest new reactor designs under its “combined operating license” reform, for reasons indicting both the industry and the regulators. The French AREVA evolutionary design is facing its first round of NRC scrutiny while experiencing major cost overruns and schedule delays in construction of a new unit in Finland. U.S. regulators at the end of the year rejected a modified advanced reactor design from Westinghouse for the AP1000 that they had earlier approved. Westinghouse made changes in the shield building to protect the reactor from airline strikes, earthquakes, hurricanes, and tornadoes. The NRC said those changes raised new licensing issues. General Electric, according to the NRC, never provided design details for its advanced boiling water reactor sufficient to judge the safety of the machine (Figure 6).

Figure 6. New nuclear queue grows. The location of planned new nuclear plants in the U.S. Source: U.S. Nuclear Regulatory Commission

Given regulatory uncertainty and the conditions of current capital markets, no rational investor is likely to commit major private-sector resources to building new nuclear plants, according to several investment bankers who talked to POWER on background. If new nukes are to be built, they argued, the effort will require large commitments of federal dollars, probably in the form of loan guarantees vastly exceeding those in the 2005 act. That’s an unlikely prospect. Even with much larger federal loan guarantees, it isn’t clear that Wall Street will commit the capital necessary to build units at $8 billion to $10 billion a pop, the latest estimates.

In Congress, feckless Republicans are calling for a fleet of 100 new nukes within 20 years, at a $700 billion price tag. That’s pure politics, or else they are smoking some powerfully atomic wacky-weed that induces weird policy visions. There is no U.S. capacity to license or build that many plants. Maybe the system could support three, or six, new nukes, but that’s a guess. A hundred? Fugetaboutit.

Waste Storage Discussions: A Waste of Time. Another blow to the prospects for U.S. nukes was the White House decision last year—no surprise—to euthanize the Yucca Mountain, Nev., project for permanent underground storage of spent nuclear fuel and other high-level nuclear wastes. The Obama administration, fulfilling a deal with Senate Democratic Majority Leader Harry Reid of Nevada, zeroed out Yucca in its budget submission early in 2009. The funding decision will stick. Sic transit gloria Yucca.

The U.S. finds itself in the embarrassing position, not for the first time, of having no practical idea about nuclear waste storage. Spent fuel rods will remain at reactor sites for the unforeseeable future, probably past the lifetime of anyone reading this article. In the wake of the administration’s decision, the NRC last September began a rulemaking that would give regulators the authority to approve at-reactor waste storage for 40 years, up from the current limit of 20 years.

The administration says it will appoint a “blue-ribbon” commission to study options for nuclear waste disposal. That’s classic D.C. talk for, “We are clueless.”

Nuclear Merger. The only positive glow for nukes was the NRC decision last October to allow Electricité de France (EDF) to buy a major share of Constellation Energy’s two-unit Calvert Cliffs nuclear plant. Baltimore-based Constellation, swimming upstream against most energy analyses, and burdened with a heavy load of debt, wants to build new (merchant) nuclear capacity at its existing Calvert Cliffs, Md., site. The only way that can happen, Constellation admits, is if it has access to EDF’s deep financial pockets, which reach into the French government’s endless treasury.

The Constellation-EDF deal won Maryland Public Service Commission approval at the end of October, but with caveats, including a commitment to invest $250 million in the company’s distribution company, Baltimore Gas and Electric (BG&E), and a $100 rate rebate to every BG&E customer, a one-time, $110 million hit for the merged company. Constellation has agreed to those conditions.

Other than the Constellation-EDF parlay, U.S. nuclear projects appear to be waiting for the nuclear Godot that will lead them into a new day of robust construction and profitable prospects. We’ve seen that play before. As Becket’s Vladimir says to Estragon, “On the other hand what’s the good of losing heart now, that’s what I say. We should have thought of it a million years ago, in the nineties.”

Skyrocketing Costs Dampen Enthusiasm

At the end of last October, the San Antonio City Council was stunned to learn that the price tag of the two new reactors at the existing South Texas Project (STP) had increased by $4 billion. The two existing reactors at STP are owned by NRG Energy (44%); CPS Energy (40%); and Austin Energy, the municipal utility of Austin, Texas (16%), although the San Antonio municipal utility had recently reduced its share in the two new nuclear projects to 20%, effectively leaving 20% of the plant unsold. CPS Energy is responsible for finding a buyer for that 20% slice of the project.

According to a knowledgeable source, the new cost estimate from the project’s primary contractor, Toshiba, is up to $4 billion higher than estimates made public by CPS in late July, which predicted a project cost of $10 billion, or $13 billion including financing.

The fate of the new units at STP is being closely followed by the industry as the STP new addition is one of only three nuclear projects that the Energy Department selected in 2009 to receive a federal loan guarantee, which will cover a good portion of the plant financing costs. NRG Energy has said it also will seek financing help from Japanese export agencies due to the role of Toshiba and other Japanese firms in the project.

The STP project would also benefit from a legislative change that the Nuclear Energy Institute (NEI) is pushing to Congress. That change would let municipal nuclear plant owners (like CPS) transfer nuclear production tax credits to private sector partners (like NRG Energy). Because munis are tax-exempt, the credits would otherwise go to waste.

The San Antonio City Council isn’t the only prospective plant owner struggling with jaw-dropping cost estimate increases. Florida Power & Light’s Turkey Point addition of two new 1,100-MW units is said to cost between $12 billion and $18 billion, Duke Energy’s Lee Nuclear Plant was last estimated at $11 billion for two 1,100-MW units at a “greenfield” plant (the estimate, by Duke in June 2009, was quoted in 2008 dollars), and Georgia Power’s two new units at Plant Vogtle are estimated at $14 billion.

The rising construction costs for new nuclear power do not necessarily translate into rates that are uncompetitive with other technologies in the future. In a commentary published in The Energy Daily, Richard J. Myers, vice president of policy development at the NEI, made the case that new nuclear plants can be cost competitive:

The National Research Council’s recent analysis shows a 6–13¢/kilowatt-hour (kWh) cost range for new nuclear plants. The low end represents a nuclear plant financed through the DOE’s loan guarantee program. This is better than coal-fired capacity with carbon capture and storage (CCS) at 9–15¢/kWh, and significantly more stable than gas-fired combined-cycle generation, which could be the lowest- or the highest-cost option, with a range from 4¢/kWh (unrealistically low gas prices, no carbon controls) up to 21¢/kWh with high gas prices and CCS.

Using the capital cost assumptions built into its annual energy outlook, the Energy Information Administration calculates that new nuclear will have a levelized capital cost of $107.30/MWh in 2016. Advanced coal with CCS is at $122.60/MWh; gas-fired combined cycle at $115.70/MWh; onshore wind at $141.50/MWh (cost of gas-fired back-up power not included).

In the 2009 update to its 2003 report, The Future of Nuclear Power, the Massachusetts Institute of Technology shows nuclear energy at 6.6¢/kWh absent the “technology risk premium” (i.e., when the first few plants have been built). Coal-fired and gas-fired plants are at 6.2¢/kWh and 6.5¢/kWh without CCS, 8.3¢/kWh and 7.5¢/kWh with carbon controls, respectively.

Upgrades Sustain Nuclear Industry

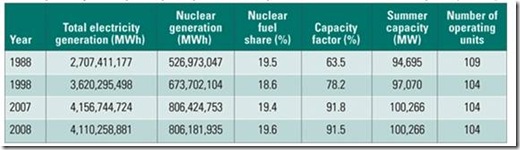

The nuclear power industry enjoyed another banner year in 2008 and, although the data isn’t in on 2009 yet, expect the data to be similar to 2008. The industry’s average plant capacity factor remained above 90% for the second year in a row in 2008, and the 104 U.S. nuclear power plants (35 boiling water reactors and 69 pressurized water reactors) produced more than 800 million MWh—just a tenth of a percent less than in 2007.

The early EIA data shows that 2009 will become the third straight year that the industry produced more than 8000 million MWh with more record-breaking performances by many plants. In 2008, sixteen of these plants recorded capacity factors greater than 100%, which is a phenomenal achievement. Exelon Corp., for example, reported that its 17 reactors finished the year with a fleet wide average capacity factor of 93.9% and operated above 93% for the sixth consecutive year. In comparison, the industry average for coal-fired plants is about 70%, and for wind turbine plants it was slightly less than 25% in 2008, according to the U.S. Energy Information Administration.

Equipment and controls upgrades at nuclear plants have also increased the rated power output of selected plants over the past few years. During 2008 alone, the Nuclear Regulatory Commission (NRC) approved a combined 726 MW of power uprates, which are normally unavailable to coal-fired plants, given the limitations of New Source Performance Standards.

Since 1977, the NRC has approved some 124 nuclear power plant uprates, representing about 5,640 MW of added capacity—roughly equivalent to constructing another five complete nuclear power plants. If you consider the enormous increase in the industry’s average capacity factor over the past 20 years, improved plant operations are equivalent to at least another dozen plants (Table 2). The nuclear industry received an “A” on its 2008 report card in plant operations.

Table 2. Expect another “A” for 2009, although the final data is not yet available. Source: EIA

The nuclear uprate program that is driving these upgrades will remain strong in 2010 and beyond. There are currently nine power uprate applications in the NRC queue awaiting approval that total another 949 MW. In addition, the NRC expects nuclear operators to submit a total of 40 uprate applications between now and 2013, representing another 2,075 MW of installed capacity. For example, Exelon announced in late September a series of power uprates across its fleet that will increased the rated capacity of its plants between 1,300 and 1,500 MW within eight years “without turning a spade of earth,” said Exelon Nuclear President and Chief Nuclear Officer Charles (Chip) Pardee at the press conference. “With these uprates, we will be able to produce the equivalent output of a new advanced nuclear reactor, and we’ll bring it to market in a timeframe commensurate with the fastest new construction.”

Slow but Steady: King Coal Keeps on Keepin’ on

Then there is coal, the Rodney Dangerfield of generation: It just doesn’t get any respect. Surprise: New coal-fired projects, unlike the nukes, are actually under construction in the U.S., and some are likely to start pushing out power soon. Despite deep political opposition from environmentalists and competing technologies, coal still generates more than half of U.S. electricity. It’s a reminder of Billy Joe Shaver’s 1950s bluegrass hit, “I’m just an old lump of coal (but I’m going to be a diamond someday).”

According to the Department of Energy’s National Energy Technology Laboratory, in June 2009, 36 coal-fired plants were either under construction (23), near construction (4), or permitted (9), for a total of 19.4 GW of new capacity. That’s in the face of a heavy assault on coal by environmental groups concerned with carbon dioxide emissions. Also joining the no-coal chorus in Appalachia are local opponents of mountain-top mining and others challenging coal ash waste disposal at power plants, in light of the Tennessee Valley Authority’s 2009 major ash dam collapse.

Not all of those coal plants the EIA identified will actually join the grid. It’s not a walk in the generating park. For example, in November, MDU Resources Group Inc. announced it was canceling its planned 600-MW Big Stone II coal project in South Dakota. The reason was that its partners in the project were unwilling to pony up the cash for the plant. But some new coal projects will succeed, as coal continues to be the pragmatic least-cost approach to baseload power.

Financial results demonstrate coal’s staying power. West Virginia–based Massey Energy Co., the fifth-largest U.S. coal producer, and the largest producer of central Appalachian coal, at the end of October reported profits for the third quarter of 2009 of $16.5 billion (19 cents per share) on revenues of $536 million, a bit below third quarter 2008 figures. For the first nine months of 2009, Massey’s EBITDA (earnings before interest, taxes, depreciation, and amortization) was $374 million, compared to $242 million for the first three quarters of 2008. This is not the picture of a dying industry.

Coal has many overt enemies but also lots of grassroots support. Miners and other union workers in the industry support the dusky diamonds (“dirt that burns,” as some have described the mineral). Coal mining, both underground and on the surface, creates high-paying jobs in places where there often are few other opportunities for work. Those jobs translate into economically viable communities, as miners and their families support local businesses from grocery stores to car dealers to dentists. In southwestern West Virginia and eastern Kentucky, flat land is hard to find, and mountain-top removal has plenty of friends, not just miners but also business folks and local consumers. That translates into political power for coal-state politicians.

Will generating and anti-pollution technologies impact the coal equation? Industry hype about coal claims it can be “clean,” citing as-yet-unproven technologies for gasification, carbon capture, and CO2 sequestration. At the same time, environmentalists claim that “clean coal” is an oxymoron, akin to “military intelligence.” Neither side has made its case. Nor is it likely the verdict will come in 2010.

The coal industry and the DOE are subsidizing projects to strip CO2 out of coal-fired plants and stuff the greenhouse gas into places yet untested. Carbon dioxide, of course, was once thought to be a beneficial byproduct of burning coal. Now, quite the opposite.

So far, nothing in the world of capturing CO2 from coal and storing it somewhere else approaches commercial scale. Indeed, some analysts are suggesting that coal plants should not be the major focus of attempts to reduce U.S. CO2 emissions. Instead, they argue, as reported in a fine New York Times article, there are more emissions bangs for the buck in working on capturing CO2 at “oil refineries, chemical plants, cement factories and ethanol plants, which emit a far purer stream of it than a coal smokestack does.”

Look for further carbon capture technology research in 2010. This technology is a long way from commercial development and may slow investment in further large-scale coal plant projects in the year ahead.

Congressional energy legislation in 2010 could pressure coal, as Congress searches for ways to reduce greenhouse gases. Those political moves against coal may prove quixotic. Coal is too powerful in Congress to take a major hit. In addition to generating 55% of U.S. electricity, coal is found (although not necessarily mined) in more than half of the U.S. states and used to generate electricity in far more than those. Coal has major political muscle in both business and labor camps.

The new head of the AFL-CIO, Rich Trumka, former chief of the United Mine Workers of America, is a western Pennsylvania coal miner who worked his way through college and law school with a miner’s helmet and lamp on his head. It’s unlikely coal will see its business or political position eroded in the year ahead if the savvy Trumka has anything to do with it. There’s a good bet he will be behind the political stage and helping to direct the drama.

The (Slim) Green Machines

It isn’t clear these days which technologies—coal or nukes or water—are the environmental movement’s true bête noir (dark beast). Nukes are out of the question for some because of waste. Coal attracts loathing because of conventional pollution, CO2 emissions, and land-use issues. Hydro kills trout and smaller fish you have never heard of.

What’s left are wind, solar, biomass, geothermal, and conservation (and who can argue with conservation?). Maybe Die Grunen just don’t like any kind of centrally-generated electricity? Light up the candles.

Niche generation, widely known as “renewable energy,” a term without a rigorous definition, accounted for about 8% of U.S. energy consumption in 2008, according to the EIA. That portion of the market should grow in 2010. Renewables may be able to increase their market share through state renewable energy portfolio standards and various state and federal subsidies. Any federal legislation mandating a renewable standard would be unlikely to have any impact in 2010 or 2011.

The self-proclaimed “green” generating technologies will continue to occupy small market opportunities, not supplanting conventional baseload generation such as coal and nuclear, or dispatchable generation such as coal, hydro, and gas. That’s clear from government statistics.

What is renewable? The definition is important. Many environmentalists conveniently ignore large hydropower as “renewable,” an omission that makes some political-correctness sense (the opponents of hydro don’t like falling water that kills fish. Historically, some of the environmental movement’s deepest roots—those connected to John Muir and David Brower—are intimately bound to opposition to hydroelectricity dams. Hydro is, for these folks, out of the question when it comes to substantial energy generation.

Eschewing water power is nonsense in terms of renewable electric capacity. The EIA says that of the 372 billion kWh of generation from renewables in 2008, 248 billion kWh came from “conventional” hydroelectricity, meaning big water such as Hoover Dam, Glen Canyon, the Missouri River system, the Columbia River system, the Lower Colorado River Authority, and others. By contrast, wind, the next-largest contributor to renewable generation, provided only 52 billion kWh. Solar checked in at a tiny 843 million kWh, last place among the EIA renewable technologies.

Wind and solar will continue to grow exponentially in 2010. That’s easy. They start from a very low base, so exponential growth remains trivial. Will wind and solar make major contributions to electric generation and electric supply in 2010 and displace statistically significant amounts of fossil generation? The chances are slim and none. Slim just left the room.

Which Way Is Wind Blowing?

The American Wind Energy Association (AWEA), the Washington lobby for wind power, reported that its industry installed some 1,200 MW of new capacity in the U.S. in the second quarter of 2009. That’s a solid performance, bringing the wind total for the first six months of 2009 to 4,000 MW, well ahead of the first six months of 2008. In a press release, AWEA acknowledged that it is “seeing a reduced number of orders and lower level of activity in manufacturing of wind turbines and their components.” AWEA said this is “troubling in view of the fact that the U.S. industry was previously on track for much larger growth.”

However, translating pure installed capacity into useful generation leaves much to be desired. The Electric Reliability Council of Texas (ERCOT), where wind turbine construction leads the world, now sports 10% of its installed capacity as wind against 65% natural gas. ERCOT’s annual summer assessment reported that there are 8,135 MW of installed wind capacity.

However, when calculating the portion of that capacity that is available to help manage peak demand, ERCOT takes a very pragmatic view: “For summer peak capacity, ERCOT counts 8.7 percent of wind nameplate capacity as dependable capacity at peak in accordance with ERCOT’s stakeholder-adopted methodology.” So for every 1,000 MW of wind power installed, only 87 MW are predicted as available to trim the summer peak. ERCOT’s installed generation capability is 72,700 MW. A summer peak demand of 64,056 MW is predicted for 2010.

The wind supply chain, noted AWEA, is experiencing troubles as companies “have stopped hiring or have furloughed employees due to the slowdown in contracts for wind turbines. Wind turbine component manufacturing investment was one of the bright spots in the economy in 2008, with over 55 facilities added, expanded or announced that year.” No more, it appears.

Denise Bode, AWEA’s CEO, said, “Manufacturing investment is the canary in the mine, and shows that the future of wind power in this country is very bright but still far from certain. The reality is that if the nation doesn’t have a firm, long-term renewable energy policy in place, large global companies and small businesses alike will hold back on their manufacturing investment decisions or invest overseas, in countries like China that are soaring ahead.”

Deconstructing Bode’s canary metaphor, if the future of the U.S industry is bright, the canary must be doing quite well, and singing gleefully. It doesn’t appear that the canary is gasping for air in her scenario, although the implication of her statement is that Tweety Bird has a raspy cough. The windy canary, it seems, is neither a positive nor a negative indicator.

One of Bode’s previous jobs was serving as head of a lobbying group promoting natural gas, a product that will kill canaries quite quickly (and people, too, under the right circumstances). Her AWEA statement is further evidence that Washington lobby-speak is often incoherent.

Scoping out wind’s prospects, Shane Mullins of Industrial Info Resources (IIR) said in late September, “After a record-setting year in 2008, wind power is on target for a mediocre 2009, but prospects for 2010 and beyond are extremely bright. Last year was a great year for wind power installations, so good, in fact, that a lot of projects scheduled for construction in 2009 were pulled into 2008. But last year’s collapse of the tax equity market cut new wind construction in half.”

In 2008, said Mullins, construction began on more than 9,000 MW of new wind power capacity in the U.S., but through mid-September 2009, construction had begun on only 4,162 MW of new wind projects, according to data collected by IIR. “For all of 2009, we’ll be lucky if we see construction begin on a total of 4,500 MW of new wind projects,” said Mullins. For 2010, who knows?

Slow Slog on the Solar Road

Solar electric generation has become the stepchild of politically correct renewables. While wind has boomed, relative to its starting position, solar has seen a much slower path to gaining market share and much less attention in the news media. Solar’s consistent problem has been cost. With generous subsidies and tax benefits, wind has reduced its nominal (including subsidies) upfront costs to below those of coal and nuclear. No so for sun power.

Solar energy, both photovoltaic (PV) and thermal, has seen capital cost reductions. A recent Lawrence Berkeley National Laboratory study of grid-connected solar PV technology found a substantial trend of cost reductions, averaging over 3% per year for a decade, mostly driven by government subsidies. But the starting point was so high that the solar generating technologies remain uneconomical for most uses.

A McKinsey and Co. analysis of solar’s prospects is cautiously bullish about the sun. Says the review, “A new era for solar power is approaching. Long derided as uneconomic, it is gaining ground as technologies improve and the cost of traditional energy sources rises. Within three to seven years, unsubsidized solar power could cost no more to end customers in many markets, such as California and Italy, than electricity generated by fossil fuels or by renewable alternatives to solar. By 2020, global installed solar capacity could be 20 to 40 times its level today.”

But the McKinsey report, featuring its conditional verb—“could”—notes that the technology is starting from a tiny base and “is still in its infancy. Even if all of the forecast growth occurs, solar energy will represent only about 3 to 6 percent of installed electricity generation capacity, or 1.5 to 3 percent of output in 2020.” The places that McKinsey projects that solar could be competitive are already extremely high-priced markets.

The Bottom Line: What You See Is What You Get

Where does all that leave generating markets in 2010? Looking not very different than they did in 2009, with the exception that natural gas has jumped onto the fuel stage in a big way. Coal perks along, with new plants under construction and some likely to come online. New nukes are ephemeral. Renewables can nicely fill generating niches but won’t dent the big generating market. They will make money but won’t change the U.S. generating mix.

Only gas looks likes a game-changer, given the emphasis on drilling in shale in the U.S. and elsewhere. The new exploration and production technologies and new gas reserves in shale probably won’t make a big impact in 2010, given lead times. They might in 2011. If they do, gas could alter the way the world looks at energy and electric generation. Stay on board for what could be a wild ride

—Dr. Robert Peltier, PE is editor-in-chief of POWER. Kennedy Maize is Executive Editor of MANAGING POWER

It seems to me that instead of dumping billions of dollars into loans for nuclear plants, we should be pumping hundreds of thousands of dollars into answering the question:

Why is building nuclear plants so damned expensive?

A reasonable assessment of the near future. Thanks. The politicalization of the nation’s electricity supply virtually assures the “wild ride” promised here.

The so-called capacity “credit” for wind at ERCOT–8.7%–is identical to the capacity credit of a stopped clock on an hourly basis; since it is statistically derived, however (unlike the clock), there is no assurance that even this amount of the nameplate capacity would be available at any key future time.

Those who compare wind and solar, which produce no effective capacity, to the precision, controllable dispatch of conventional generation–and then demand that these feckless energy sources replace the modern power capacity of coal and nuclear–are truly delusional. And electricity consumers, as well as taxpayers, will continue to pay more and receive less, for reduced capacity will mean less secure electricity supply.

The natural gas juggernaut has already begun, with national ads boasting how its low carbon generation can complement, even enhance, the growth of wind and solar. What is unsaid is the cost of such tandem development, both in terms of increased dollars and CO2 emissions.

Re: “It’s a reminder of Billy Joe Shaver’s 1950s bluegrass hit, ‘I’m just an old lump of coal (but I’m going to be a diamond someday).'”

The Billy Joe Shaver tune is entitled “Old CHUNK of Coal”, it was written in 1981, and it is decidedly NOT bluegrass. Wow, I hope the remainder of your article is more factually based than this doozy.