Solar Bankruptcies: The New Normal

By Robert Bradley Jr. -- August 20, 2025“Never again; let the free market choose winners and let government not pick losers.”

Remember Solyndra, a solar panel manufacture that collapsed soon after receiving a $535 million loan guarantee from the US government back in 2011? This company received the U.S. Department of Energy’s first loan guarantee under the American Recovery and Reinvestment Act of 2009, an infamous beginning that embarrassed President Obama and the “green” energy industry.

Today, 14 years later, the erroneously described “infant” industry is badly listing with its perennial tax subsidies at risk. Grid solar is plagued by failure, with investors facing net zero and employees looking for alternatives. Customers are disgruntled as well.

Enter SolarInsure, whose business is about “safeguarding your renewable energy investment with energy system monitoring and warranties.” SolarInsure has compiled a list of bankrupt solar firms in the interest of filling claims for nonperformance. The “Complete List of Solar Bankruptcies and Business Closures” begins:

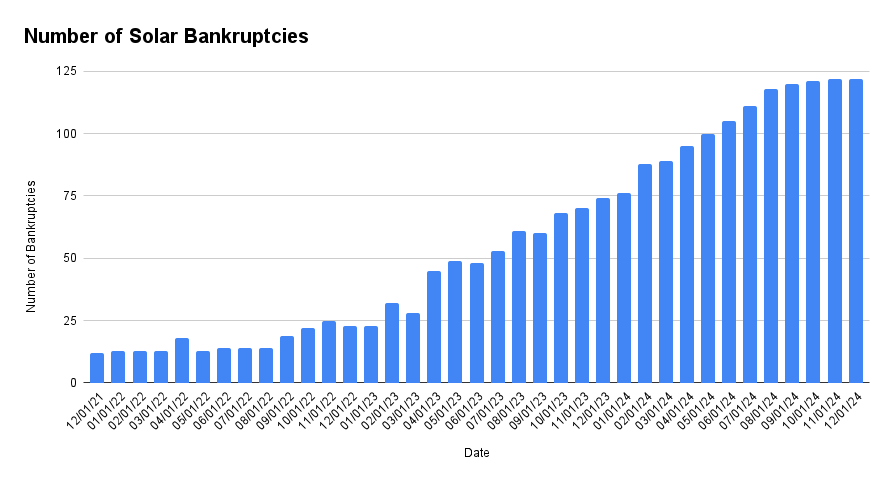

The solar industry experienced exponential growth over the last decade as costs fell and favorable policies helped drive mass adoption. However, 2024 has brought immense challenges, with higher interest rates, tighter financing, and adverse policy shifts in key states contributing to over 100 solar bankruptcies based on our industry data, a number unseen before in our almost 20 years in the solar sector.

California was particularly hard hit due to new net metering rules under NEM 3.0 that radically reduced system economics. These adverse state policy impacts exacerbated financing shifts, triggering plummeting demand and an 80% decrease in rooftop solar installation volume. The California Solar & Storage Association reports that the fallout includes thousands of stalled projects, over 17,000 industry layoffs, and a wave of high-profile bankruptcies.

The note ends:

While stronger players demonstrate some resilience, impacted homeowners and solar employees face prolonged uncertainty. The outright collapse of many once fast-growing solar firms provides a sobering case study on the potential unintended consequences of incentive transitions.

In other words, the wish list enacted by the solar industry in the Inflation Reduction Act of 2022 created an artificial boom that politics is now reversing. Same for the California Green Dream that was brought back to reality on simple social justice grounds (average ratepayer pain from solar roofs for the well-off and highly educated).

The casualty list (cumulative, below) is large, and it will grow as state and federal subsidies contract.

In comparison, oil and gas insolvencies, which peaked during the 2020 Pandemic, have been less in a far larger industry than solar. [1]

Major Solar Bankruptcies as of June 2025 Include:

- Sunnova – Multiple States

- SunPower – Multiple States

- Pink Energy – Multiple States

- MC Solar – Modern Concepts – Florida

- Harness Power – California

- NM Solar Group – New Mexico

- ASA – American Solar Advantage – California

- Kuubix Energy – California

- Erus Energy – Arizona

- Infinity Energy – California

- Suntuity Renewables – Per Sunova – NJ, CA , TX

- ADT Solar – Multiple States

- Vision Solar – Multiple States

- Solcius – CA, NM, AZ, NV

- Sunworks, Inc. – CA

- Kayo Energy – AZ, CA, TX, FL

- iSun – CT

- Titan Solar Power – Multiple States

- Lumio Solar – Utah

- Expert Solar – Florida, Texas

- Shine Solar – LA, AK

California Company Closures:

- Altair Solar

- ASA – American Solar Advantage – CA

- Bratton Solar- CA

- Canapoy Energy – CA

- Charged Up Energy – CA

- Enver Solar – CA

- Harness Power – CA

- GCI Solar – CA

- Green Nrg – CA

- Kuubix Energy – CA

- Peak Power USA – CA

- Penguin Home- CA

- Polar Solar – CA

- Professional Roofing and Solar – CA

- Sigora Home Solar – CA

- Solsun USA – CA

- Solar 360

- Solar Advantage – CA

- Sullivan Solar Power – CA

- Sungrade Solar – CA

- SunPower – CA

- Sunstor Solar – CA

- RGS Energy – CA

- Solar Spectrum – CA

- Sunworks, Inc. – CA

- Swell Energy – CA

- United Solar Inc. – CA

Texas Company Closures:

- Alternative Solar

- American Sun

- Daybreak Solar Power

- Cosmo Solaris – DBA WNK Associates , Under Investigation

- Envirosolar

- Hitech Solar

- Integrity Solar

- Next Energy

- Nivo Solar

- Speir Innovations

- TES Home Solar

- Texas Solar Broker LLC

- Texas Solar Integrated LLC

- Verisolar

- Vulcan Solar

Other States:

- 3D Solar – Florida

- AAA Certified Solar – Nevada

- Accept Solar – MA

- ACE Solar Systems – AZ

- Arizona Solar Concepts – AZ

- Brimma Solar – WA

- Code Green Solar – NJ

- EcoMark Solar – CO

- Elan Solar – UT

- Electriq Power – FL

- Encor Solar – UT

- Gulf South Solar – LA

- Moxie Solar – IA

- Refresh Energy Group – CO

- Saveco Solar – UT

- Solar Is Freedom – OH

- Solar Titan USA – TN

- SolarDot – FL

- Solarworks – AZ

- Solular, LLC – NJ

- Utah Solar Group – UT

- Voltage Solar Power – FL

- Zenernet – AZ

Think about opportunity costs. Imagine if all the resources wasted in this boom-to-bust political play had gone to human betterment, such as improving resiliency to weather extremes or aiding in disaster recovery. Pick your business or favorite charity. We can see the solar waste, exemplified by companies from Solyndra to Sunnova. Never again; let the free market choose winners and let government not pick losers.

—————-

[1] According to AI Overview: “US oil and gas bankruptcies since 2022“:

According to reports, the number of oil and gas bankruptcies in the US has declined considerably since the pandemic-driven high of 2020 (107) and 2021 (56):

- 2022: Mining, oil, and gas bankruptcies accounted for only 4% of all bankruptcy filings in 2022.

- 2023: This figure further declined to 1% in the first half of 2023.

- 2024: The first half of 2024 saw an increased number of large corporate bankruptcy filings across various industries, including a notable uptick in Finance, Insurance, and Real Estate. However, the data does not specifically focus on the oil and gas sector for this period.

- 2025: Projections for 2025 indicated a potential normalization across the oil and gas sector with around 22 Exploration & Production (E&P) bankruptcies expected, according to Rystad Energy. However, the number of overall business bankruptcies in the US rose to 23,043 in the year ending June 2025.

Hello,

I’m looking for information regarding solar farm company bankruptcies, primarily in Texas.

I’d like to find out the effects of large scale solar being built on farmland using federal subsidies and promising local government entities annual payments as well as income from business and use taxes. In Central Texas, it appears that the companies come in with large promises and once built they seem to fight appraised values and in some cases declare bankruptcy. The end result of this seems to equate to significant cuts in taxable value and reduced promised payments to counties and local government entities that have little to no resource to fight such reductions and accept a depreciated value and thus lower tax/promised payments….

thanks

Ian