Wind Benefit Inflation: JEDI (NREL) Model Needs Reality Check

By Lisa Linowes -- December 12, 2012Since 2009, the State of New Hampshire has reviewed three large-scale wind energy facilities, totaling 177 megawatts. In each case, the project proponents engaged University of New Hampshire Professor and economist Ross Gittell and his research assistant, Matt Magnusson, to conduct economic impact studies to show the long-term (20-year) benefits the projects would deliver to the local area.

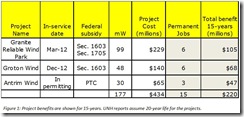

Figure 1 summarizes the findings of each report (please click for better resolution).

The UNH researchers relied on NREL’s Jobs and Economic Development Impacts (JEDI) or similar linear spreadsheet models to assess job creation and economic impacts for the three projects: Granite Reliable Wind Park, Groton Wind and Antrim Wind. The methodologies and assumptions for the three studies appear nearly identical.

In all cases, their reports showed minor direct job opportunities (15 full-time equivalent positions for operations at the three sites) but substantially inflated indirect and induced job benefits relative to the local area.

JEDI Model Problems

The JEDI models purport to enable calculating the state or local economic impacts resulting from building a potential wind energy facility. However, JEDI only looks at the positive impacts of a project and assumes that money spent is always beneficial. But that is not a safe assumption.

According to economist, Dr. Robert Michaels:

Authors of studies using JEDI acknowledge that it ‘offers a gross analysis rather than a net analysis; that is, the model does not account for the net impacts associated with alternate spending of project funds.’ …JEDI treats the renewable like a proverbial “free lunch,” a gain to the economy for which nothing need be sacrificed. Many other effects might reduce job creation or possibly turn it into destruction.

Michaels goes on to say:

JEDI’s creators recognize that the net effect of increased renewable investments on employment is ambiguous. On occasion they have cited the works of others who use more complex models …NREL’s researchers are thus aware that other models that capture important complexities are available. For unknown reasons, they instead persist in using a model that can produce only the single result of job creation from renewables.

The Navigant jobs study commissioned by the American Wind Energy Association, which uses JEDI models, suffers the same failures. It wasn’t until Congressional members hammered NREL earlier this year over unsubstantiated and inflated job creation claims under the Section 1603 program that NREL finally updated its website to more publicly admit that JEDI models produce gross impacts and not net impacts.

JEDI and New Hampshire Wind

In reviewing the methodologies for each of the UNH economic impact reports, we could find no indication that the models accounted for project costs. When we asked the UNH researchers if their report for Antrim Wind, for example, considered net impacts at first they said no, but later amended their response to say they looked at the costs and found there were none.

Seriously?

Apparently, Gittell and Magnusson do not think it’s relevant that both the Granite Reliable Wind and Groton Wind projects have, or will receive, approximately $111 million in Section 1603 grant money from the federal government; Antrim Wind expects to benefit from the production tax credit. Most economists would consider the federal subsidies to be a cost borne by U.S. taxpayers, including those residing in New Hampshire.

Gittell and Magnusson also ignore another substantial cost factor in their analyses — the fact that the Granite Reliable and Groton wind projects each have long-term power purchase agreements with in-region utilities at contract prices that are well above market rates for wholesale electricity. Antrim Wind has made it clear it is also seeking a long-term purchase agreement which is required to obtain financing.

When asked if their Antrim Wind analysis considered the impact of above-market energy prices, Gittell replied that “there has been no contract for the sale of the power from the Antrim Wind Project at any price, therefore there is no foundation for the question and it cannot be answered.” A convenient but misleading and badly informed answer.

Gittell’s economic model utterly neglects the fact that onshore wind in New England demands between 9-11 cents per kWh, more than twice the wholesale price of natural gas, the fuel most likely to set the market price. More wind in the fuel mix will cause upward pressure on energy prices in New England for the life of the power purchase agreements.

Since wind energy largely produces during off-peak hours, when market prices are even lower, the delta between the contract price and the market price for the energy is even more pronounced.

And it looks like low natural gas prices will be the new normal for a long while. The Energy Information Administration’s Annual Energy Outlook 2013, released last week enforces the fact that we can expect low natural gas prices, facilitated by growing shale gas production, over the next 15 years!

Gittell, Magnusson, and the developers for the three projects all insist wind provides a hedge against fluctuating energy prices. This may be true in some regions of the country but not in New England, where 90+% of the generation operates in the day-ahead market. Wind could have a marginal impact on prices in the real-time market but any benefit is entirely erased by the high-priced power contracts.

Big Wind – Economic Drain

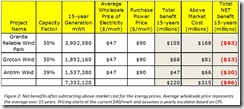

At the very least, the high cost of the New Hampshire wind power contracts will exceed the economic benefits touted by the UNH researchers and will serve as a drain on New England’s regional economy (see Fig. 2: please click for better resolution).

Gittell’s simplistic conclusion that the benefits of the operating projects will enrich the host communities and surrounding areas disregards the fact New Hampshire residents do not live in isolation. Many work, shop, and recreate in neighboring states and will be impacted by the high cost of these projects.

According to our analysis, the three projects (assuming Antrim Wind is erected) will result in significant costs to the New England region in above-market energy prices alone. Other costs related to property values, tourism, and impacts to the environment are also likely to arise.

There is no excuse for the sloppy work of Gittell and Magnusson who, in our opinion, have ceded their credibility for their wind clients. But shame on New Hampshire’s energy siting board for not understanding the projects they’re approving in the context of the regional power market.

This article is a good example of how ‘gilding the lily’ by these wind farm proponent economists has morphed from being an occasional spurt of enthusiasm for a subject, to a full time professional operation.

In addition, the stunning ability to ignore the bleeding obvious has gone from being an intermittent lapse in judgment, to common practise.

Next they’ll be saying that humans can affect the climate. Is there no end to these flights of fantasy?

Lisa,

Thanks for the article and the information you’ve included.

Using the values from your tables, I calculated the internal rate of return on investment (IRR) for the wind projects assuming that there were no maintenance costs. (This is assumption is only because I don’t know these numbers and the numbers weren’t listed above.)

The inputs into my IRR calculation were the following: (1) $2.5/W upfront capital costs in year zero (2) 25 year lifetime of operation, (3) average electricity sale price of $47/MWh, (no inflation included), and (4) 33% capacity factor.

Using excel’s IRR function, I calculated an IRR of 3%/yr using the data you included. This is a pre-tax, inflation-adjusted IRR.

A value of 3%/yr means that the system could just barely self-replicate. 3%/yr is really low given that building a new NGCC power plant could likely get you an IRR of ~20%/yr. (Though, 3%/yr is a lot better than 1.1%/yr…which is the value of IRR I calculated for the ability of my wife and I to self-replicate…i.e. to have 3 kids in our mid-late thirties.)

The problem with power plant projects with low values of IRR is that we can’t grow our society our of our debt crisis unless our power plants achieve high rates of return on investment. (To really grow society, we need power plants with pre-tax, inflation-adjusted IRR greater than ~8%/yr…where you calculate the IRR using the sale price of electricity at the time in which the power plant was being constructed.)

Thanks again for sharing the data you’ve collected.

wh0cd424355 viagra