Economic/Environmental Assessment of Grid-Tied Photovoltaics: Arizona Lessons for the U.S.

By David Bergeron -- June 7, 2010[Editor note: David Bergeron is president of SunDanzer Development, Inc., a solar energy company located in Tucson AZ. This is his first post at MasterResource. More information on him and his company is provided at the end of this post.]

The proponents of the Arizona Renewable Energy Standards (RES) make various claims in order to promote grid-tied solar photovoltaic (PV) electricity. Unfortunately, the use of grid-tied solar PV is unlikely to accomplish any of the objectives suggested by its proponents. Specifically,

- It will not create jobs in Arizona;

- It will not reduce global warming;

- It will not reduce electricity prices;

- It will not reduce our dependence on imported oil; and

- It will not position Arizona to be a leader in renewable energy.

Furthermore, there is a good chance that the RES will have outcomes that are directly opposite its intended effects.

The suitability of Solar PV as a grid-tied energy source can be analyzed in a straightforward manner. In Tucson, Arizona, a 1 kW residential or commercial grid-tied PV system costs approximately $5,000 installed[1] and may offset up to $66/year[2] of fossil fuel use. This 76 year simple payback is well beyond the life of the equipment and does not include maintenance cost.

Adding PV to the grid offers no other significant savings in utility generation and transmission requirements and only adds to administrative and engineering burden for the utility. Despite idealistic claims of infrastructure savings from distributed grid-tied PV, these do not exist in the real world because PV is not reliable power, so no significant reduction in generation or transmission infrastructure is possible.

PV system costs must fall by at least a factor of five[3] to offer real value in reducing fossil fuel use. Additional evidence of this is the fact that current federal, state, and utility subsidies cover 65-75%[4] of the up-front cost of these systems and net metering laws provide a rich subsidy for energy produced and yet the systems are still only marginally viable.

Perhaps if grid-tied PV were the only available alternative to fossil fuels its low rate of return could be overlooked. But there exist many alternative fuel sources that demonstrate a much higher rate of return[5]. Many of these initiatives are very promising and already contribute to the economy and environment; solar hot water, off-grid solar PV, geothermal energy, and one day possibly wind energy, solar thermal power generation and biofuels.

These technologies as well as energy conservation and energy efficiency measures all have rates of return higher than grid-tied solar PV. Grid-tied solar PV makes sense only in a world in which we have fully exhausted all better renewable alternatives, a world which, thankfully, is many generations away.

One of the reasons that support for grid-tied PV persists is the perception that the technology provides a legitimate way to spend government money that will, as it usually does, stimulate the economy and create jobs. While we do not dispute that the current economic environment may suggest that government spend more money than it otherwise would, both state and federal budgetary outlays ought to still be governed by strict cost-benefit analysis.

Government ought to pursue those projects and policies that demonstrate the highest rate of return without regard for their political appeal. This will always result in the greatest good provided to the constituency, and that translates into the most jobs in the long run. We have no more business building highways to nowhere than building large-scale PV to nowhere. If simply spending money created jobs, it would be easy work for government. But spending money wisely is the job of government, and by spending money unwisely, it can only expect businesses to go to another state, thereby losing jobs in the long run.

In Arizona, the utility subsidies alone will likely exceed $150M [6] ($25 per person) in 2010. This subsidy money comes directly from the pockets and bank accounts of the ratepayers in Arizona. Spending this money in the solar industry will create solar jobs, but will result in an equal reduction of spending for other goods and services Arizonans would have bought had the money not been taken away from them. Politicians claim job creation and capitalize on the apparent success, but the truth is each solar job comes by destroying a job in other segments of the economy. Many voters are fooled because the solar jobs are visible and can be counted, but the lost jobs are diffuse and spread over the state economy in a way which makes them hard to see and number. But there is no free lunch, the $150M taken from the general economy to fund the solar jobs is a zero sum jobs game at best to the state economy.

Additionally, proponents claim that tying PV to the grid will, despite its financial costs, reduce the state’s emissions of greenhouse gasses (GHG). This argument supposes that although grid-tied PV is a big money-loser, we as taxpayers are essentially purchasing carbon offsets to mitigate the problem of global warming. There are two main reasons grid-tied PV is not the right solution for achieving this objective.

First, there is no strong evidence that, once properly measured, PV produces less GHG per KW-hr than coal or natural gas and at least some evidence that it produces more[7]. While several papers have been written which indicate that the energy payback of PV is quick[8], a proper accounting would include the energy opportunity cost of the non-energy inputs[9]. The energy payback studies ignore the value of all other inputs, such as labor, materials, land, and capital. Once used to make and install a PV system, they are no longer available to be used to save energy in more optimal ways, thus the opportunity to save energy is lost. Using price signals rather than embodied energy analysis prevents the error of ignoring energy opportunity cost and results in the most cost optimal approach to saving energy and CO2.

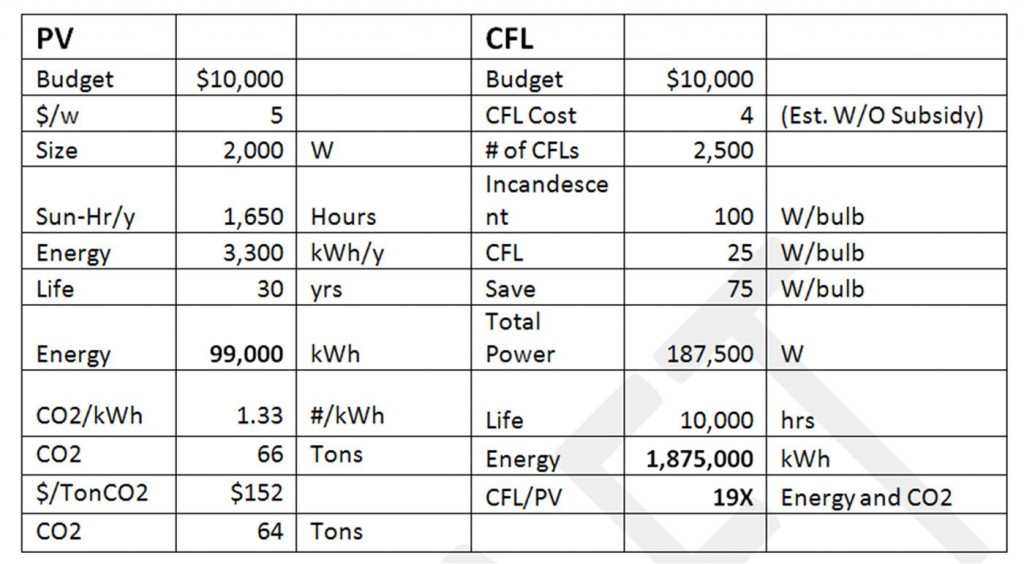

Second, if reducing GHG is the objective, there exist many better alternatives, particularly energy efficiency measures. As just one example, investment in compact fluorescent light bulbs to replace incandescent bulbs saves 19 times [10] more CO2 than the same investment in grid-tied PV for a given CO2/kWh fuel mix.

Ignoring the embodied CO2 and lost opportunity cost of grid-tied PV systems, they will save CO2 at a cost of about $152/ton (US Average Fuel Mix). This number would be considerably higher, if the “CO2” savings were offset by the embedded CO2. But, ignoring that, CO2 credits are traded in Europe for about $20/ton[11], meaning that alternative measures to reduce CO2 are available for about 8x less cost than Solar PV.

Investment in grid-tied PV is also promoted as a means to reduce dependence on oil imports. This, however, is a false assumption. Oil is an important strategic fuel for our national economy and developing technologies to safeguard against foreign supply disruptions is both rational and prudent. However, installing solar PV on our power grid will have little impact on our oil dependence, since we use mostly coal, gas, nuclear, and hydro to make electricity, not oil[12]. In fact, mandates on utilities to pay for grid-tied PV will raise the average cost of electricity, making oil more competitive rather than less, causing an increase in oil imports.

For example, if our PV mandates drive the price of electricity higher, as is expected, the relative cost of driving an electric or plug-in hybrid vehicle will rise relative to a conventional vehicle. This will discourage motorists from switching away from gasoline, thereby increasing our reliance on oil.

Finally, there is a desire among many in Arizona to develop our state as a leader in the field of solar power. While it is true that Arizona is blessed with abundant solar energy, so are New Mexico, Nevada, West Texas, Southern California, Colorado, and Utah[13]. Thus it is unlikely we will develop significant exports of solar power to our neighbors. Nor is it realistic to assume Arizona will be a major exporter of solar panels. To accomplish this would require a low-cost business-friendly atmosphere and a cluster of similar technology businesses. Regrettably, high electric rates and state taxes resultant from our RES are likely to drive businesses away and prevent, rather than promote, the desired outcome.

Solar PV has many great applications. It has the ability to be transformative to the billions of people who live removed from the electrical grid. But tying PV to the grid in order to give ourselves the illusion of creating a better world is counterproductive, and the sooner we commit our scarce resources to real solutions the better off we will all be.

[1] http://www.solarbuzz.com/Moduleprices.htmThe Solar Buzz provides recent prices for PV modules and balance of system equipment. Per their website, as of May 2010, PV prices average $4.21/Wpeak. They also state that the modules are 50-60% of the total system cost. Therefore, the total system cost is $7.02 to $8.42 per watt. However, the Solar Buzz is not clear as to whether the system is off-grid or grid-tied (grid-tied is our system of interest). My personal survey of installers in Arizona shows much lower prices are possible if the consumer seeks a few bids. In Southern Arizona, the price for an installed PV system is closer to $4.5 – $5/watt. For my analysis, I used $5 per watt. I also assume a price based on a 5 kW installation and scaled the price down to a 1 kW system for the analysis. A 1 kW installation would cost about $6-$8/W.

[2] I personally spoke to Ed Fox of Arizona Public Service (APS), Karen Cathers of TRICO, a retired Exec from Tucson Electric Power (TEP), and a RE staff engineer from the Salt River Project (SRP). All four people clearly and directly stated that the value of Grid-tied PV to these utilities is fuel avoidance cost only, which runs from 2.7 to 4 cents per kWh. A more complete analysis should include the real-time price data for match solar output, but this data has proven to be hard to acquire. Dr Severin Borenstein wrote a paper (The Market Value and Cost of Solar Photovoltaic Electricity Production, 2009) on this effect and concluded that PV is worth 0 to 20% more than average pricing. For this analysis I used 4 cents/kWh as the average fuel avoidance cost. Finally, I used 1,650 kWh/yr net system output, which is indicative of a very high sun region with continuously operating equipment. So the value of fuel saved is 1650 * 4 cents = $66/yr.

[3] Current prices indicate a simple payback period of 76 years for residential grid-tied systems, but large systems (>MW) in Arizona have simple payback periods closer to 60 years when used to offset higher cost fuels. ($4/W + maintenance, 4 cent fuel avoidance). If PV cost were to drop by a factor of 5, the simple payback would be 12 years and might be economically viable. However, it is difficult to imagine the total system cost dropping by a factor of 5, since about ½ of the cost of these systems are the installation, inverter, and inverter periodic replacement.

[4] Example: 5 kW Grid-Tied PV System in Tucson Electric Power (TEP) District:

Cost: $25,000 @ $5/w

TEP Credit: $15,000 ($3/W)

Federal Credit: $3,000 (30% of balance)

State Credit: $1,000 (25% up to $1000)

Total Credit: $19,000

Credit/Cost = 19/25 = 76%

This can be created and verified at http://sharpusa.cleanpowerestimator.com/default.aspx Zip Code: 85718. Utility: TEP (May 26, 2010). TEP currently offers one of the highest PV credits in the state.

[5] http://www.eia.doe.gov/oiaf/aeo/electricity_generation.html Not only are geothermal and biomass considerably less expensive, they are available ‘on-demand’ which further enhances their value. Wind, while intermittent like solar PV, is considerably less expensive than PV.

[6] The APS 2009 Renewable Energy Standard Compliance Report shows APS to have a total RE budget of $78.4M. APS Produced about 24% of the state’s electricity in 2008. I assume the RE expenditures are fairly level between utilities as a percent of total output, so the total state utility budget for RE is probably about 4x that of APS’s budget. The actual total RE expenditure may be closer to $200-$250M/yr in Arizona. http://www.eia.doe.gov/cneaf/electricity/st_profiles/arizona.pdf.

[7] http://www.docstoc.com/docs/25710235/ASES-Paper-M183—Final

[8] Emissions from Photovoltaic Life Cycles

Vasilis M. Fthenakis, Hyung Chul Kim and Erik Alsema

Environ. Sci. Technol., 2008, 42 (6), pp 2168–2174

Publication Date (Web): February 6, 2008 (Article)

DOI: 10.1021/es071763q

Energy Pay-back Time and CO2 Emissions of PV Systems

E. A. Alsema*

PROGRESS IN PHOTOVOLTAICS: RESEARCH AND APPLICATIONS

Prog. Photovolt. Res. Appl. 8, 17±25 (2000)

[9] Subsidies to New Energy Sources: Do They Add to Energy Stocks?

William J. Baumol, Edward N. Wolff

The Journal of Political Economy, Vol. 89, No. 5 (Oct., 1981), pp. 891-913

Published by: The University of Chicago Press

Stable URL: http://www.jstor.org/stable/1830812

1.33 #CO2/kWh from http://www.eia.doe.gov/cneaf/electricity/epa/epat3p9.html & http://www.eia.doe.gov/cneaf/electricity/epa/epaxlfilees1.pdf

I was told by a state energy official, that the subsidy is about 50% of the cost, therefore a fair market price of $4 should be a good assumption. I have not been able to verify the cost of a CFL without subsidy. http://www.1000bulbs.com/23-Watt-Compact-Fluorescent-2700-Kelvin/

[11] http://www.instituteforenergyresearch.org/germany/Germany_Study_-_FINAL.pdf, page 6 of 40

[12] http://www.eia.doe.gov/cneaf/electricity/epm/table1_1.html

[13] http://www.fsec.ucf.edu/en/media/enews/2007/images/PVout.jpg

——————————————

David Bergeron founded SunDanzer in 1999 and currently serves as President and CEO. SunDanzer has operations in Qingdao, Monterey, Tucson, and El Paso with 15,000 square feet of office, laboratory, manufacturing, and warehouse space.

SunDanzer performs R&D for NASA and the Department of Defense in the area of solar powered cooling equipment, manufacturers in the USA, and exports solar refrigeration equipment to every continent.

Before starting SunDanzer, Mr. Bergeron worked in aerospace on 3 satellite projects over 20 years and was the technical lead on the COMET reentry satellite. He has 6 patents in satellite and solar energy systems design. He attended Rice University, Texas A&M, and the University of Houston with degrees in Mechanical Engineering and Finance. Mr. Bergeron’s 8th grade science project was a solar PV powered car and he has been an avid alternative energy enthusiast ever since.

David,

I appreciate the thoroughness of your study. I am stuck a bit on comparing $5,000/installed kW for solar to $66 of annual fossil fuel use. I think it is fair to assume that given demand for power will continue to rise and as such we will be building new capacity in some form or another. The comparison could include the per kilowatt cost of installed fossil fuel capacity that is negated in response to building the renewables. You would know better than me, but I was seeing numbers around $1,000 per kW for NG and high marks of twice that for coal. That would cut a big chunk of years off the model already. It we were comparing to coal there are that sea of externalities that carry costs associated with health and clean up repercussions to factor in as well.

Grid-tied PVs may still not be on par when it comes to cost, but they may be a lot closer than a 76 year oblivion.

*Granted, you run into replacing baseload power with intermittent supply and the need for supplemental storage, etc. etc.

but, T. Caine, the fact you’ve asterisked, means that the ” per kilowatt cost of installed fossil fuel capacity that is negated in response to building the renewables” is not negated as it needs building anyway.

I suppose that would be true if power storage costs $2,000 a kilowatt. I read that GM and Toyota are already talking about the reuse of EV batteries as renewable power storage and prices were less than that.

T. Caine, thanks for that additional information, I had not heard it. Although as used batteries, I assume they would not last the life of the PV system and would need to be replaced periodically, and hence increase their (life time) costs. Further, inverters for PV systems tend to have poor lifetimes and require replacement, also upping net present cost. In any event if you have a link to GM/Toyota talks re battery reuse, I would appreciate a link or some additional info.

T. Caine, I agree that if PV could offset peak demand generation then its value would be greater than simple fuel avoidance. But Solar PV output peaks around 12-1pm and peak demand is closer to 5-6pm in Arizona. We also have monsoon rain patterns which allow peak electrical demand simultaneous with cloud cover. See http://theenergygame.blogspot.com/2010/03/peak-demand.html for an explanation of this. The “fuel avoidance” claim is very important to my argument that PV is a long way from economic viability and I wanted to make sure it was accurate, so I contacted executives from 4 major electric utilities in Arizona, who all agreed that PV was only worth fuel avoidance. So as demand grows, I think we will have to build the traditional plants.

I’m sure it is possible to put a number on the ratio of rated PV to peak load availability, I just think this number might be in the range of 10-20% for grid-tied solar PV systems. I also agree that storage or demand management would make PV and other intermittent renewables more viable.

Tom, here is one of the articles I had found talking about plans to reuse EV batteries.

http://business.timesonline.co.uk/tol/business/industry_sectors/utilities/article7094211.ece

Part of the allure seemed to be that when an EV battery ends its useful link in an automobile, it can still have 70% of its storage capacity. I also read that car companies aren’t releasing the production costs of making lithium-ion batteries, but outside estimates are around $1,000/kwh (Nissan Leaf has a 24kwh battery.) So if this could actually work, you could lower the net consumer price of EVs and raise the viability of renewable power storage (that would get a used battery at a deal) to displace carbon when powering the cars. It may be all rather theoretical at this point, but it could be a positive direction of things to come.

David, thanks for your response. I agree that offsetting peak generation is key for renewables which they will never be able to do without solid storage opportunities.

[…] The oversupply of panel production is the direct result of government subsidies for solar. The article, in part, credits the oil price boom for the investment surge, but solar is not a substitute for oil. Installing solar panels does not reduce our oil imports. Solar PV offsets electricity and only about 1% of our electricity is made from oil, so I can’t believe investors invested in solar in response to high oil prices, nor for the reason of climate concerns, since solar is a very expensive means of reducing GHG emissions. […]